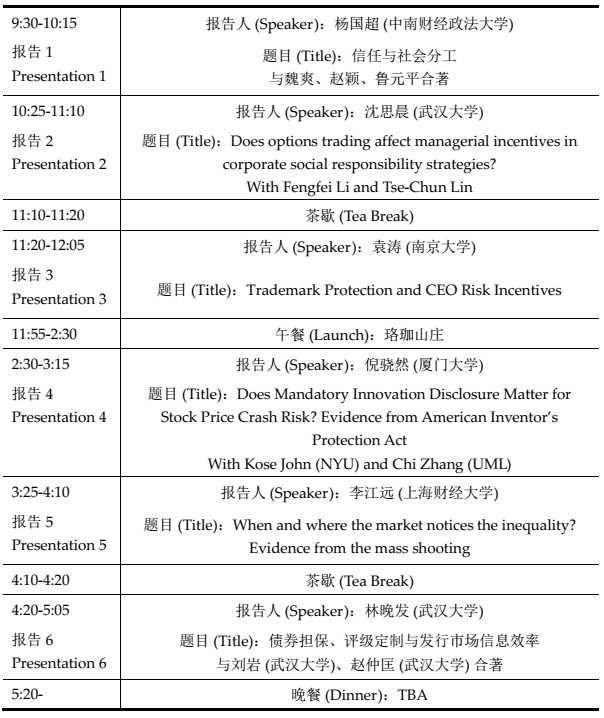

一、议程 (Schedule)

时间 (Time):2020/11/15

场地 (Venue):A321

二、报告人及文章摘要

1. 杨国超 (Prof. Guochao Yang)

个人简介 (Bio):中南财经政法大学会计学院副教授、收入分配与现代财政研究院财政大数据研究中心主任、文澜青年学者,复旦大学管理学院财务金融系博士,入选财政部国际化高端会计人才。主要研究方向为股票市场、债券市场和公共政策领域的制度与非制度因素分析。论文发表于(含待刊发)《经济研究》(3篇)、《管理世界》、《经济学(季刊)》(2篇)、《世界经济》、《金融研究》、China Journal of Accounting Studies(2篇)等国内顶级学术期刊。曾获得2017年China Financial Research Conference(CFRC)最佳论文奖、第十二届湖北省社会科学优秀成果一等奖、武汉市第十六次社会科学优秀成果一等奖等。主持国家自然科学基金、教育部人文社科基金以及多项湖北省课题。

文章题目 (Title):信任与社会分工

文章摘要 (Abstract):社会分工是推动经济增长的源动力,但仅依靠法律制度无法保障社会分工充分精细化。鉴于此,本文研究信任对研发外包这一具体的社会分工行为的影响。研究发现,信任有助于企业的研发外包活动。同时,本文还发现,地区失信程度会对企业研发外包行为产生负面影响。此外,信任对企业研发外包行为的积极作用在知识产权保护水平越低、交通便利程度越高、服务业越发达和金融越发达的地区更为显著,即较完善的法律制度会对信任有一定的替代效应,同时经济发展成熟的地区存在更多重复博弈机会,反而会导致信任的溢出效应更大。进一步地,本文发现信任与研发外包的正向互动关系会促进企业的专利产生,从而提高了企业的全要素生产率,即高信任环境通过促进企业研发外包战略的实施使企业效率得到了显著提升。

2. 沈思晨 (Prof. Sichen Shen)

个人简介 (Bio):沈思晨博士2019年毕业于香港大学,研究领域为公司金融,公司治理,企业社会责任。其工作论文曾受邀在多个高水平学术会议做报告,包括American Finance Association、Financial Management Association,SFS Cavalcade Asia-Pacific、中国国际金融年会等。

文章题目 (Title):Does options trading affect managerial incentives in corporate social responsibility strategies?

文章摘要 (Abstract):We posit that more managerial hedging opportunities and lower career concerns induced by active options trading provide stronger managerial incentives to implement corporate social responsibility (CSR) strategies. We find that firms with more options trading tend to have better CSR performance. This effect can be attributed to several channels, including product market competition, takeover exposure, reputation and goodwill, CEO career horizon, and pay-risk sensitivity. We find consistent results using a quasi-natural experiment that reduces options trading costs of treated firms. Insider hedging transactions also corroborate our findings. Overall, active derivative markets have real effects on shaping firms’ CSR strategies.

3. 袁涛 (Prof. Tao Yuan)

个人简介 (Bio):南京大学商学院助理教授,博士毕业于香港城市大学经济与金融系,他的研究领域主要为公司金融,包括企业科技创新,IPO,CEO薪酬等。研究成果已发表在Journal of Financial and Quantitative Analysis,主持一项国家自然科学基金研究项目,同时他还是特许金融分析师(CFA)持证人。

文章题目 (Title):Trademark Protection and CEO Risk Incentives

文章摘要 (Abstract):We study the impact of trademark protection on risk incentives in CEO compensation contracts. Using the Federal Trademark Dilution Act as an exogenous shock on the legal protection of trademarks, our difference-in-differences estimation shows that stronger trademark protection induces firms to increase CEO risk incentives as measured by CEO portfolio vega. The positive impact of trademark protection on vega is greater for firms operating in a more competitive environment, with higher innovation intensiveness, and with weaker corporate governance. Overall, our findings suggest that, by creating monopoly power in the product market, stronger trademark protection entrenches CEOs enjoying a quiet life while shareholders provide more risk incentives in the compensation design to motivate risk-taking.

4. 倪骁然 (Prof. Xiaoran Ni)

个人简介 (Bio):倪骁然,2012年、2017年于清华大学经济管理学院分别获得经济学学士、应用经济学(金融学方向)博士学位。2015年9月-2016年9月在美国密歇根大学(安娜堡分校)罗斯商学院接受联合培养。现任厦门大学经济学院、王亚南经济研究院助理教授。主要研究领域为公司金融,当前研究专长主要包括利益相关者视角下的公司治理、制度变化与企业行为、企业信息环境。在《经济研究》(2篇)、《管理世界》、《经济学(季刊)》、《金融研究》(2篇)、《中国工业经济》、Journal of Corporate Finance(4篇)、Journal of Banking and Finance(2篇)等国内外重要学术期刊发表论文20余篇。主持国家自然科学基金青年项目。多次获得国际国内学术会议最佳论文奖。

文章题目 (Title):Does Mandatory Innovation Disclosure Matter for Stock Price Crash Risk? Evidence from American Inventor’s Protection Act

文章摘要 (Abstract):Employing the passage of the American Inventor’s Protection Act (AIPA) that requires firms’ patent applications to be published 18 months after filing, as a quasi-exogenous shock to innovation disclosure, we find that accelerated innovation disclosure results in higher stock price crash risk. This effect is stronger among firms whose innovation process tends to generate more bad news and are technologically closer to their peers, and becomes less prominent when trade secret protection is stronger. Further analysis reveals that firms more affected by AIPA tend to strategically adjust towards less conservative financial reporting and sustaining higher discretionary accruals. Overall, we document that mandated timelier disclosure on patenting may induce managers to strategically garble information, which potentially increases stock price crash risk.

5. 李江远 (Prof. Jiangyuan Li)

个人简介 (Bio):上海财经大学助理教授,2020年毕业于新加坡管理大学,获金融学博士学位。论文发表于国际顶级金融学期刊Journal of Financial Economics,国际著名金融学期刊Journal of Banking and Finance和国际著名运筹学期刊European Journal of Operational Research。

文章题目 (Title):When and where the market notices the inequality? Evidence from the mass shooting

文章摘要 (Abstract):I investigate the cross-sectional inequality-return relationship in the equity market from a geographical angle. I document that the negative inequality-return relationship (Campbell et al. 2016 and Toda and Walsh 2019) still holds in cross-sectional level. Additionally, the negative inequality-return relationship is largely driven by the firms that locate on mass shooting treated regions and mass shooting periods. I attribute the empirical fact to attention channel that after observing long-term cooccurrence between inequality increase and mass shootings, public attention to inequality issues would be spurred when treated by a mass shooting

6. 林晚发 (Prof. Wanfa Lin)

个人简介 (Bio):林晚发,会计学博士,武汉大学经济与管理学院副教授,研究方向为信用评级与债券定价,以第一作者在《中国工业经济》、《金融研究》、《会计研究》、《审计研究》、Annals of Economics and Finance、Finance Research Letters、China Journal of Accounting Studies与China Journal of Accounting Research等期刊发表论文20多篇。主持国家自然科学基金一项,教育部人文社科项目一项,参与社科重大项目一项。

文章题目 (Title):债券担保、评级定制与发行市场信息效率

文章摘要 (Abstract):企业债券融资同时具有事前逆向选择和事后道德风险两方面的信息摩擦,而债券担保与评级是两个标准的市场化解决机制。然而债券发行企业与评级机构配合实施的评级定制行为,却可能大幅降低债券发行市场的信息效率,导致定价失准。为了深入剖析这个问题,本文首先构建了一个理论模型,对评级定制行为和债券市场信息效率进行了机制刻画。在此基础上,本文利用我国公司债在交易所发行交易需要满足2A债项评级这个制度背景,系统检验了债券担保、评级对债券发行定价的影响。实证结果显示,我国债券市场的确存在评级定制问题:企业有动机通过增加担保以提高债券评级,造成评级“虚高”以及担保“失效”,降低了债券发行市场的信息效率。但同时,债券投资者也具有一定的评级定制甄别能力,对含担保债券提高了发行利率,获得风险溢价补偿。详尽的异质性检验和机制检验进一步巩固了实证结果的稳健性。本文的理论与实证结果说明,为了进一步推动直接融资市场高质量发展,需要统一考虑债券担保与评级制度体系,切实提高债券市场信息效率。